Include the index in the contract with partners

-

Present the index internally

Arrange a meeting with the decision maker. Invite a lawyer, an accountant and an employee who will monitor the dynamics of the index..

-

Coordinate index implementation with colleagues

At an internal meeting, determine the wording of the relevant section in the contract. Indicate the range of the index change, think on indicators you should revise prices.

-

Negotiate with partners

Organize a meeting of colleagues and partners, and present the index. Offer to include an index in the contract.

-

Appoint designated empoyee

After signing the contract, assign employees who will monitor the dynamics of the index regularly

Basic rule when working with a chart

+/- 10%

It is recommended to revise the price if the index falls or rises by 10 percent or more.

Details >

Find out when you were selling profitably and when you suffered financial losses

-

Download CSV table

After selecting the parameters you are interested in, use the button in the lower right corner of the chart.

-

Add to Excel

Add a CSV to Excel, and the second column is your transaction prices for the same period.

-

Compare prices and trends

Build a line chart and compare if your sales match the trends in the market.

Consider two examples of graphs obtained in Excel

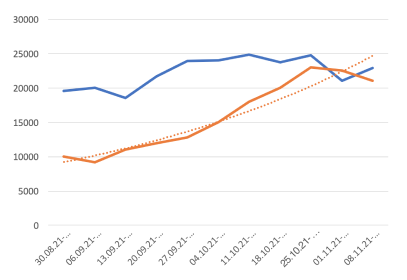

Example 1: Analysis of prices for the sale of waste paper

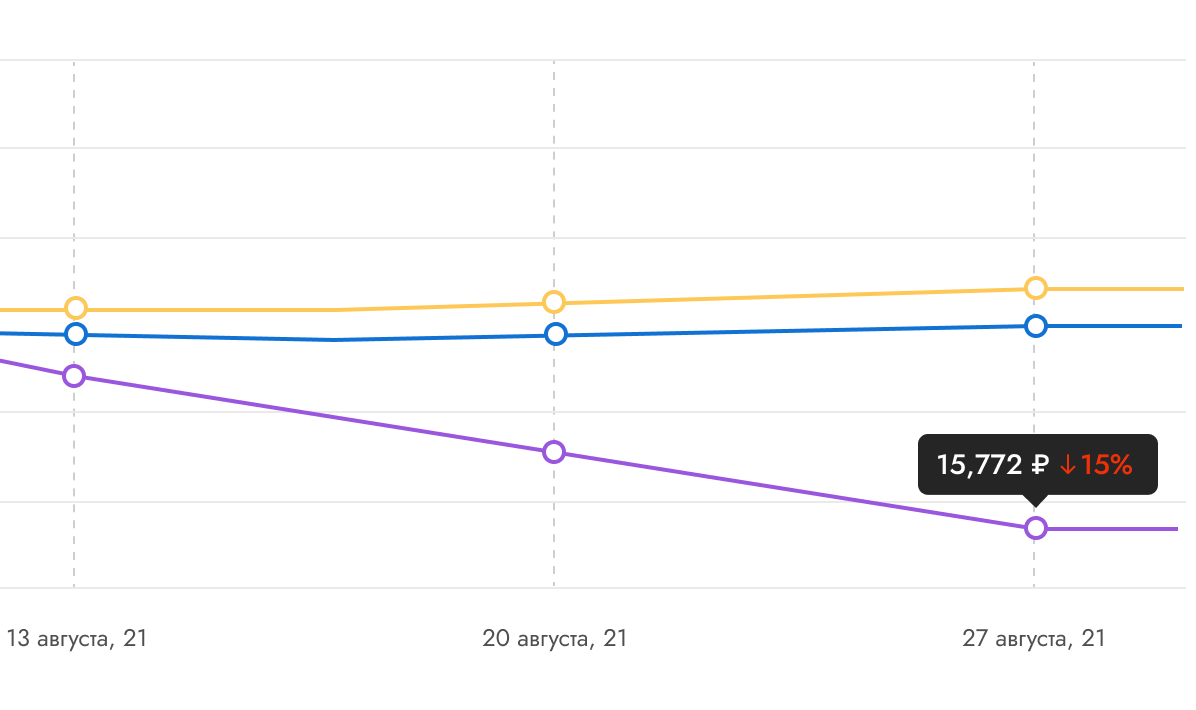

MS-5B price index, ton

MS-5B sale price, ton

Conclusion 1

According to the blue chart of the index, we can see that the weighted average price for MS-5B waste paper was higher than the price the company sold for eight weeks. Consequently, the company suffered significant financial losses while the market was ready to buy waste paper at a higher price.

Conclusion 2

From 10/18/21, the company included the pulp and paper index in the contract. After that, we see that the price is in the 10% range of the index. Both parties can be sure that the transactions align with the market situation and that there is no reason to renegotiate prices.

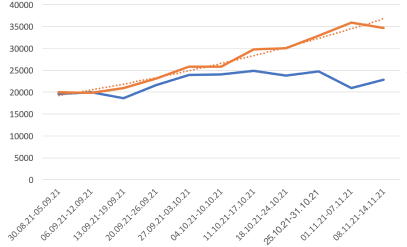

Example 2: Analysis of prices for the purchase of waste paper

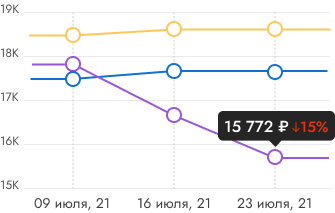

MS-5B price index, ton

MS-5B sale price, ton

Conclusion

We see that the buyer bought the waste paper for seven weeks at a price that corresponded to the dynamics of the index and did not deviate by more than 10%. Further on the chart, we see that the seller raised the price, while the trend throughout the market was to the downside. The buyer's ignorance led to monetary losses

Subscribe to pulp and paper indices updates

Delta of +/10% is a recommendation

Each company determines the threshold at which it will revise prices. When setting the threshold, consider the following factors:

The actual transactions in your company and the industry, namely the range of historical price fluctuations. To do this, you can analyze historical data by downloading the index data for the year and combining it with your company's transaction data.

The average amount of a transaction in your company. You can easily calculate actual losses or incomes in absolute terms at various thresholds and choose the most comfortable one for you.

Partner opinion. Discuss this percentage with partners when including the index in the contract. Designate what % fluctuation of the index will be significant for each side.